Atlantic National Bank, Providence, RI (Charter 2913)

Atlantic National Bank, Providence, RI (Chartered 1883 - Receivership 1913)

Town History

Providence is the capital and most populous city of the U.S. state of Rhode Island. It is the third-most populous city in New England with a population of 190,934 at the 2020 census, while the Providence metropolitan area extending into Massachusetts has approximately 1.7 million residents, the 39th-largest metropolitan area in the U.S. It is the county seat of Providence County.

Providence is one of the oldest cities in New England, founded in 1636 by Reformed Baptist theologian Roger Williams, a religious exile from the Massachusetts Bay Colony. He named the area in honor of "God's merciful Providence" which he believed was responsible for revealing such a haven for him and his followers. The city developed as a busy port, as it is situated at the mouth of the Providence River at the head of Narragansett Bay.

Providence had 29 National Banks chartered during the Bank Note Era, and all 29 of those banks issued National Bank Notes.

Bank History

- Organized March 28, 1883

- Chartered April 3, 1883

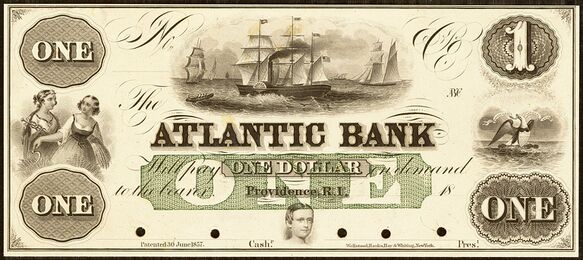

- Succeeded Atlantic Bank

- Receivership April 16, 1913

The Atlantic bank was chartered in May 1853. In February 1853, the petition for a charter for the Atlantic Bank and the Act to incorporate the city of Newport were continued in the House with an order of notice issued.[2]

On April 3, 1883, the comptroller of the currency authorized the Atlantic National Bank of Providence, Rhode Island to begin business with a capital of $225,000.[3]

Judge Eli Aylsworth was a member of the General Assembly from 1854-1867, a director in the Merchants Savings Bank in 1845 and a vice president of the same for 20 years. He was also a director of the Atlantic Bank and the first president of the Jackson Bank. Since 1858 he was a director and president of the Westminster Bank. In 1838 he was elected one of the judges of the Court of Common Pleas of Providence County. At about 10 years of age, he earned a few dollars hoeing potatoes and these he saved and were still in the big vault at the Westminster Bank as he celebrated his 90th year.[4]

On November 23, 1894, Caleb G. Burrows dropped dead at the Central Baptist Church where he had gone with Mrs. Burrows to attend the first of the series of socials. Mr. Burrows was born in Providence 78 years earlier and was educated in the public schools of his native city. His father, Joseph Burrows, was the famed hardware merchant of Christian Hill. In 1836 both embarked in the lumber business, the firm at the time of Mr. Burrow's death being Burrows & Kenyon. Deceased was one of the founders of the Atlantic Bank and at the time of his death was president of the Atlantic National Bank.[5]

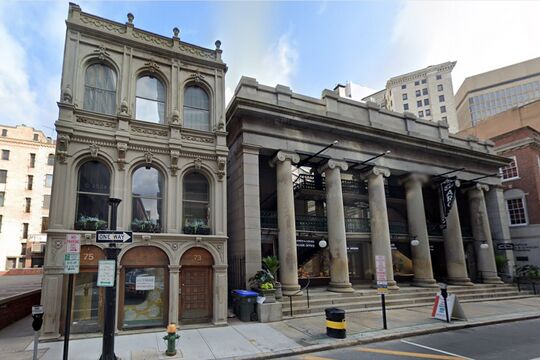

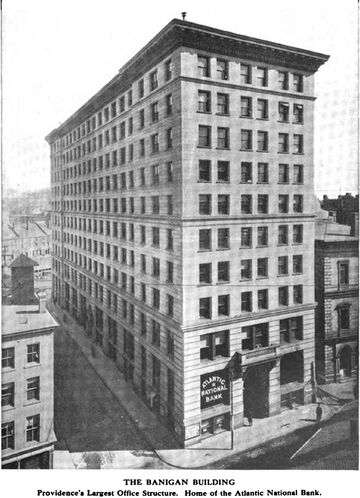

In May 1906, E.P. Metcalf, formerly president of the Old National Bank was elected president of the Atlantic National Bank. Mr. Metcalf's position of as superintendent of the Plainfield Street Free Baptist Sunday School had made him well-known to many residents of the annex.[6] The officers in June were Edw. P. Metcalf, president; James S. Kenyon, and Ernest W. Tinkerham, vice presidents; and Frank W. Peabody, cashier. The bank was at 10 Weybosset Street, Banigan Building, Providence.[7] In November 1906, the directors in order to strengthen the surplus funds voted to increase the surplus to $110,000. This represented a voluntary payment of $20 a share making $90,000 which was added to the former surplus of $20,000 for a total of $110,000. Along with the capital of $225,000, ample funds were available to take care of the increased business. The growth of deposits from $250,000 to $1,500,000 in less than five months made the step advisable.[8]

| Bank | Capital | Surplus and

Profits |

Deposits |

|---|---|---|---|

| Atlantic National Bank | 225,000 | 160,000 | 2,500,000 |

| Blackstone National Bank | 500,000 | 315,000 | 1,190,000 |

| National Bank of Commerce | 850,000 | 515,000 | 2,750,000 |

| National Exchange Bank | 500,000 | 800,000 | 1,500,000 |

| Mechanics National Bank | 500,000 | 200,000 | 2,000,000 |

| Merchants National Bank | 1,000,000 | 775,000 | 6,200,000 |

| Phenix National Bank | 450,000 | 625,000 | 1,300,000 |

| Providence National Bank | 500,000 | 780,000 | 1,250,000 |

| United National Bank | 500,000 | 725,000 | 4,000,000 |

| Central Trust Co. | 200,000 | 25,000 | 250,000 |

| Industrial Trust Co. | 3,000,000 | 4,000,000 | 40,000,000 |

| Rhode Island Hospital Trust Co. | 1,000,000 | 2,180,000 | 32,500,000 |

| Union Trust Co. | 1,000,000 | 500,000 | 14,800,000 |

In 1908, the officers were Edward P. Metcalf, president; James S. Kenyon and Ernest W. Tinkham, vice presidents; Frank W. Peabody, cashier; and George H. Capron, assistant cashier. The directors were George E. Boyden, John J. Connly, John M. Dean, Arthur W. Dennis, Henry Fletcher, Henry W. Harvey, Frederick W. Hartwell, Orrin E. Jones, Franklin S. Jerome, James S. Kenyon, Edward P. Metcalf, John S. Murdock, Frank W. Peabody, Joseph G. Robin, David F. Sherwood, P.R.G. Sjostrom, Ivar L. Sjostrom, Edwin A. Smith, Oscar Swanson, Ernest W. Tinkham, D. Henry Wellman, Walter W. Whipple.[11]

In May 1909, Franklin S. Jerome connected with Norwich Bleaching, Dyeing and Printing works and as president of the Thames Loan and Trust Co. and First National Bank of Norwich was elected a director of the Atlantic National Bank of Providence and of the Chatham National Bank of New York City.[12]

On April 14, 1913, the Atlantic National Bank, one of the older institutions of Providence, failed to open its doors for business. On the big plate glass windows there was found a big notice which read: 'This bank is closed pursuant to the order of the Board of Directors." There was no great excitement in financial circles and no crowd of depositors or interested persons gathered about the banking rooms. The greatest surprise was that the institution collapsed so quickly after the retirement from the presidency of Edward P. Metcalf last week. He resigned because of overwork and nervous troubles, and was succeeded by Percy W. Gardner, a lawyer, the president of the Young Men's Republican Club. At the same time there came a change in the board of, directors, Everett W. Tinkham, a well-known woolen manufacturer of Burrellville, was chosen as the chairman of the board. For a long time there have been rumors connecting stability, of the Atlantic, but Pres Metcalf at all times insisted that the bank was as sound as the Rock of Gibraltar. The bank was turned over to the custody of Joseph Balch, the National Bank Examiner for this district, and he and his assistants were in full charge at noon. The depositors were believed to be fully protected. It was stated that the bank would not reopen for business for a considerable time, if at all. The assets of the bank include a large amount of so-called dead or unsalable securities and also stock of the United States Finishing Company, which recently went short funds to carry on its business.

The Atlantic Bank secured palatial quarters in the Grosvenor Building, in bank house center, a few years earlier. Prior to that time it had rather obscure quarters on Weybosset Street, but President Metcalf was a so-called hustler and he soon claimed that the business had grown from a million-dollar institution to a four-million dollar one. He was most enthusiastic over the concern, and wanted to make money fast, but the bank was now and then caught with worthless paper so frequently that the losses began to attract attention of more careful financiers. When President Metcalf resigned this on April 2d, he gave as the reason ill-health and suddenly announced he was going abroad. Prior to becoming president of the Atlantic Bank he was a national bank examiner. The last official call of the Comptroller of the Currency for statements of condition of all National banks of the country, at the close of business April 4, 1913, resulted in a reply from the Atlantic which was considered to be unsatisfactory.

The Atlantic's failure was due, it was believed, to errors of judgment alone, as the bank was overloaded with paper of doubtful value. While the suspension came suddenly, there had been for several days expectations in banking circles that such a step would be found necessary. The recent change in the office of president and the prior trouble over the commercial paper of some large concerns, including the United States Finishing Company, had prepared the financial district to look for trouble. At the time of the chain of bank failures in New York due to the Robin system of financiering [Joseph G. Robin, formerly Robinovitch[13]], some large accounts were withdrawn from the Atlantic, as Robin had been associated with this bank in a business way. Edwin P. Metcalf, formerly president of the Atlantic National Bank of Providence, was born in Providence in 1859, and began his business career when he was 20 years old, at which time he entered the employ of Brown Brothers & Co. of Providence, with whom he remained for four years. At the end of that period, he became assistant treasurer of the Carolina Mills Company and had charge of the sale of the product of the mills in New York City. Subsequently he entered the employ of the Rhode Island Hospital Trust Company of Providence, where he acquired a thorough knowledge of banking.[14]

On Saturday night, January 23, 1915, Edward F. Metcalf, former president of the Atlantic National Bank of Providence was found guilty in the United States District Court of misapplication of $219,785.74 of the bank's funds with intent to injure and defraud, and Henry E. DeKay, a broker of New York, was found guilty of aiding and abetting the same following one of the longest trials in the history of the state. The decision was rendered after the jury had been out for 11 hours and came at 10 o'clock Saturday night. Metcalf was found guilty on the entire ten counts of the charge. Metcalf and DeKay were released on $20,000 bonds each. The trial occupied 83 days and included the examination of 80 witnesses and 800 exhibits. The Atlantic National Bank failed with about $3,500,000 in liabilities, only few days after the resignation of President Metcalf who resigned on April 2d and sailed for Europe. Twelve days later the bank suspended payment by order of Joseph Balch, National Bank examiner. After a superficial examination the stockholders were assessed 100% and on June 12, 1914, a dividend of 25% amounting to about $500,000 was paid to depositors. Mr. Metcalf was for many years a leader in religious and church work.[15]

In March 1915, a dividend of 7 1/2% was announced by the receiver. This would make the fifth dividend for a total of 67 1/2% paid to the creditors.[16] Edward P. Metcalf began a five-year sentence in the state prison for misapplication of funds. Metcalf built up a splendid bank which was solid until John W. De Kay, "Sausage King" of the famous "Popo" brand of Mexico, and Henry E. De Kay of New York, who promoted a packing house in Mexico, began doing business with him and he had become interested in a Boston rubber concern. Metcalf was prominent socially and for years was president of the state Baptist Sunday School Union.[17]

Official Bank Title

1: The Atlantic National Bank of Providence, RI

Bank Note Types Issued

A total of $1,375,410 in National Bank Notes was issued by this bank between 1883 and 1913. This consisted of a total of 182,088 notes (182,088 large size and No small size notes).

This bank issued the following Types and Denominations of bank notes:

Series/Type Sheet/Denoms Serial#s Sheet Comments 1882 Brown Back 4x5 1 - 13250 1882 Brown Back 3x10-20 1 - 4212 1902 Red Seal 4x5 1 - 5850 1902 Red Seal 3x10-20 1 - 4340 1902 Date Back 4x5 1 - 10923 1902 Date Back 3x10-20 1 - 6947

Bank Presidents and Cashiers

Bank Presidents and Cashiers during the National Bank Note Era (1883 - 1913):

Presidents:

Cashiers:

Other Known Bank Note Signers

Bank Note History Links

- Atlantic National Bank, Providence, RI History (NB Lookup)

- Atlantic National Bank, Providence, RI History (3)

- Rare Rhode Island Red Seal (SPMC PM#82)

- Rhode Island Bank Note History (BNH Wiki)

Sources

- Providence, RI, on Wikipedia

- Atlantic Bank Building, Providence Preservation Society accessed July 15, 2025.

- Don C. Kelly, National Bank Notes, A Guide with Prices. 6th Edition (Oxford, OH: The Paper Money Institute, 2008).

- Dean Oakes and John Hickman, Standard Catalog of National Bank Notes. 2nd Edition (Iola, WI: Krause Publications, 1990).

- Banks & Bankers Historical Database (1782-1935), https://spmc.org/bank-note-history-project

- ↑ The Bankers' Magazine, Vol. 78, (Jan. - June 1909), p. 859.

- ↑ Herald of The Times, Newport, RI, Thu., Feb. 3, 1853.

- ↑ The Critic and Record, Washington, DC, Tue., Apr. 3, 1883.

- ↑ The Providence News, Providence, RI, Mon., June 6, 1892.

- ↑ The Providence News, Providence, RI, Sat., Nov. 24, 1894.

- ↑ The Olneyville Times, Providence, RI, Fri., May. 18, 1906.

- ↑ The Olneyville Times, Providence, RI, Fri., June 22, 1906.

- ↑ The Olneyville Times, Providence, RI, Fri., Nov. 16, 1906.

- ↑ The Bankers' Magazine, Vol. 76, (Jan. - June 1908), p. 929.

- ↑ The Bankers' Magazine, Vol. 76, (Jan. - June 1908), pp 923-4.

- ↑ The Bankers' Magazine, Vol. 76, (Jan. - June 1908), p. 924.

- ↑ The Bulletin, Norwich, CT, Wed., May 26, 1909.

- ↑ The Sun, New York, NY, Wed., Dec. 28, 1910.

- ↑ The Boston Daily Globe, Boston, MA, Mon., Apr. 14, 1913.

- ↑ Commercial, Bangor, ME, Mon., Jan. 25, 1915.

- ↑ Record-Journal, Meriden, CT, Tue., Mar. 2, 1915.

- ↑ The Vincennes Sun-Commercial, Vincennes, IN, Tue., Mar. 23, 1915.